Live Happily and Affordably

Find and buy your dream home within your budget

Featured Properties

Have you ever been offered a home you know you can't afford? With TRUE by TLCengine that's a thing of the past. Using cutting-edge True Lifestyle Cost® technology, you can now see how much that new home will cost per month, based on your unique lifestyle.

Virtual Open Houses

Are you looking for open houses in your area to visit this weekend? Use our search to help find homes that fit your criteria.

See How TLC Can Help

Using cutting-edge True Lifestyle Cost® technology, you can now see how much that new home will cost per month, based on your unique lifestyle.

Mortgage

Utilities

Commute

TLC: $4,031

Price:$389,900

MLS#:R1480226

67 Sturbridge LanePittsford, NY 14534

5 Beds2.5 Baths2,380 Sq.ft.

$3,660

$620

$303

The Public Facing MLS Site

Where you'll find the most current, accurate and up to date listings direct from realtors.

3:19

PM

Last MLS Update

Finding homes you can afford in today's market feels like a daunting task. Our process, backed by industry leading technology and partnerships, allows homebuyers to get pre-approved with real-time industry-leading mortgage rates, find homes they can afford, and partner with experienced agents and lenders to successfully buy their dream homes.Searching for homes in the New Jersey Area can feel stressful and time consuming. But it doesn't have to be. With Wikihale, we'll narrow the homes to just those you can afford, while providing you with a best-in-class search experience. For example, if the kitchen design matters most to you, we can show you kitchen photos first! If you want a home slightly out of your budget, we can offer strategies to improve your purchasing power.And our rates are literally the best! Here's how: all mortgage brokers receive some compensation from the lender that ultimately lends you the money (and generally, the rates are more competitive through a broker as well!). Through our partnership with TLC Financial, a (huge) portion of their income goes to paying down the rate for you. In other words, our partners are so passionate about helping you find homes you can afford that they are willing to pre-pay some of your interest for you, reducing your payments each month!Lastly, we may not have time to work with every buyer that searches on the site. You are absolutely welcome to find homes here and buy them elsewhere. BUT, if you choose to make an offer with us or one of our partner agents, we will give you a piece of the commission at closing! Here's how it works: Sellers pay the Buyer's Agent's commission at closing based on a prenegotiated rate. Top agents love working with educated, pre-approved buyers are pay us a portion of their commission. We take that and share some with you.It's really that simple: get pre-approved with the best available rates, find your affordable dream home, buy it and get cash back. Live happily -- and affordably, ever after.

The Newest Listings to Market

Have you ever been offered a home you know you can't afford? With TRUE by TLCengine that's a thing of the past. Using cutting-edge True Lifestyle Cost® technology, you can now see how much that new home will cost per month, based on your unique lifestyle.

What Can I Afford?

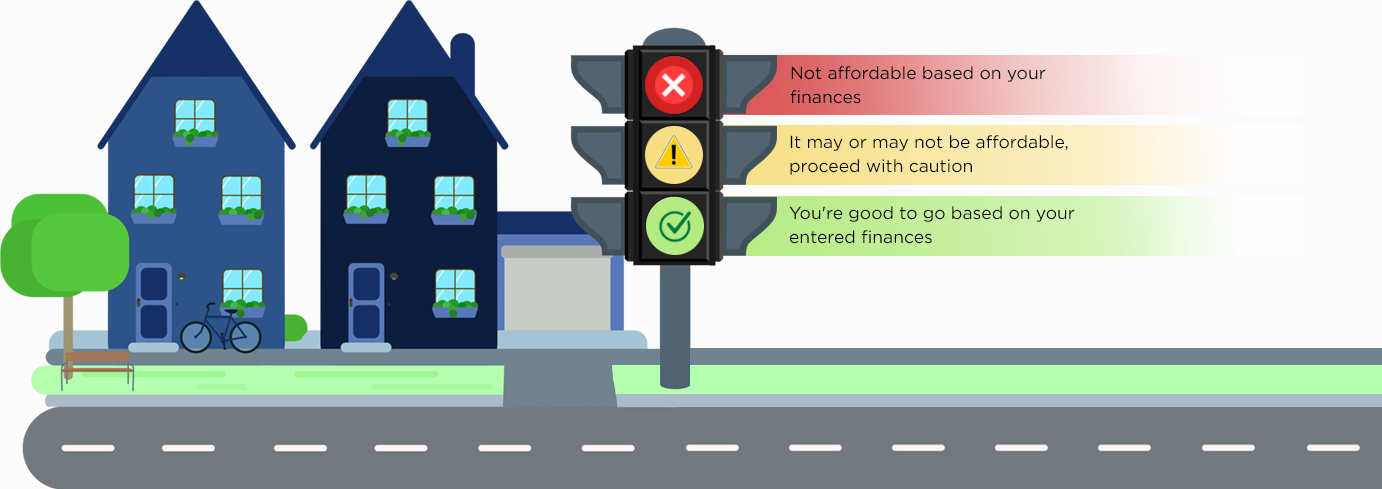

Our True Lifestyle Cost® search engine factors in mortgage, insurance, taxes, commute and more lifestyle expenses so you can find homes that fall within your budget.

What is your monthly lifestyle cost?

$500

$1000

Quickly & Effectively Know Your Affordability For A Home

Located on Every Property Details Page

Realtor ®

Your Source To Your Next Home!

Whether it's your first home, your next home, your dream home or your vacation home, a REALTOR® will help you in every step during the home buying and selling process.

They are professional, caring and knowledgeable.

Call your local REALTOR® today!

Explore Neighborhoods

Take a deep dive and browse neighborhoods to see insights around demographics, prices, incomes, education, weather, and schools to see if the homes for sale are right for you.

The Home Buying Journey

Recent Posts

Address

Keller Williams Elite

481 Memorial Parkway

Metuchen, NJ 08840

Broker License 0566404

All Rights Reserved, Each Office Independently Owned & Operated